The Future of Portfolio Management Services in India: Trends to Watch

Introduction

The world of investing is entering a powerful new phase where technology, data, and personalisation are changing everything we once knew about wealth building. The Future of Portfolio Management is no longer limited to experts or large investors. It is now an accessible, intelligent, and transparent system shaping how Indians manage their money today and in the years ahead.

Markets are becoming smarter. Investors are becoming more aware. Tools are becoming more advanced. Whether someone is stepping into investments for the first time or already managing a large portfolio, understanding these shifts is essential.

This blog unpacks everything you must know about the Future of Portfolio Management in India, supported by visual explanations and simplified insights.

A New Era Begins with Technology-Led Portfolio Management

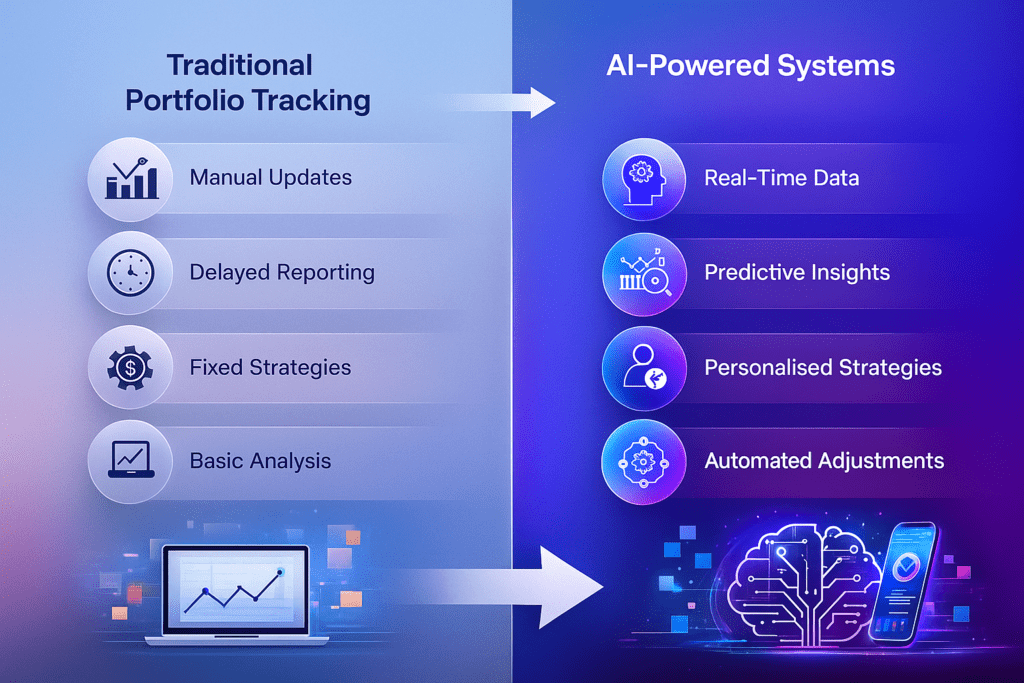

Technology is the strongest force reshaping the Future of Portfolio Management. Advanced platforms are now able to read market movements, analyse trends, and evaluate risks within seconds. Earlier, these decisions relied heavily on manual research. Today, investors benefit from data-powered precision.

Artificial intelligence can study years of price patterns across multiple asset classes and predict probable movements with a high degree of accuracy. Machine learning tools refine this analysis over time. Automation ensures quick, error-free execution. Together, they create a system where the investor receives better risk evaluation, faster insights, and more consistent performance.

This shift does not remove human involvement. Instead, it empowers portfolio managers with deeper insights they can use to design better strategies. Human judgment and machine intelligence are forming a stronger, more stable investment model.

Personalisation Will Lead the Future of Portfolio Management

One-size-fits-all investing is slowly disappearing. Investors want portfolios designed with their life, goals, and risk comfort in mind. Personalisation is becoming the heart of the Future of Portfolio Management.

Platforms now track user behaviour, financial patterns, and long-term needs to curate strategies that fit perfectly. Someone saving for retirement requires steady growth and capital protection, while a young investor may prefer a more aggressive plan.

Here is a simple glimpse of how personalisation works.

With improved analytics, every portfolio evolves according to the investor’s changing needs. This ensures long-term consistency without unnecessary surprises

Key Trends to Watch in the Future of Portfolio Management

AI and Automation Becoming the New Backbone

AI is no longer an add-on; it is becoming the core of modern portfolio management. From real-time risk prediction to automated rebalancing, AI and automation are helping investors make faster, sharper, and more informed decisions. These systems learn from market behaviour, reduce manual errors, and create smooth portfolio operations that work even when the investor isn’t actively monitoring.

Hyper-Personalised and Integrated Portfolios

Investors today expect portfolios that match their lifestyle, risk appetite, and long-term goals. The future lies in integrated dashboards where equities, real estate, alternative assets, and even sustainability-linked investments sit together. This shift towards personalised and multi-asset portfolios allows users to see their financial health holistically instead of tracking scattered investments.

Rise of ESG and Responsible Investing

Environmental, social, and governance factors are becoming central to decision-making. As investors become more conscious, portfolios that prioritise sustainability and long-term impact will gain stronger traction. These strategies not only help in ethical investing but also yield better stability in uncertain markets.

Smart Dashboards and Visual Insights

Traditional reports are making way for interactive dashboards that convert complex data into simple visuals. Investors want to understand their returns, risks, and projections instantly, and modern portfolio tools are offering exactly that. With colour-coded alerts, visual trend lines, and scenario modelling, users will feel more informed and empowered.

Mobile-First Investment Ecosystems

The future of portfolio management in India is mobile-driven. As mobile users grow rapidly, investors want complete control of their portfolio from their phones. This includes instant alerts, real-time updates, goal tracking, and seamless communication with portfolio managers, making investments more accessible than ever.

Rising Transparency and Real-Time Portfolio Tracking

Modern investors demand clarity. They are no longer satisfied with quarterly reports or delayed updates. One of the biggest pillars in the Future of Portfolio Management is real time reporting.

Digital dashboards now allow investors to check their current value, asset allocation, drawdowns, return percentages, and risk levels instantly. This real-time visibility builds trust and removes dependency on constant manual communication.

Transparency also includes clear fee structures, easy access to performance history, and well-defined risk indicators. As trust becomes a deciding factor, portfolio managers who provide stronger transparency will lead the market.

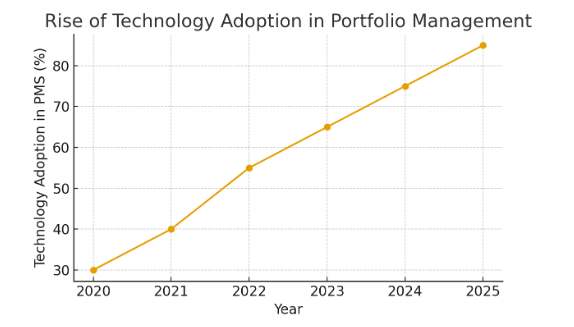

Tech Adoption in Portfolio Management

Technology isn’t an add-on anymore. It has become the foundation of modern portfolio management. From automation to real-time analytics, the industry is moving towards sharper accuracy and faster decision-making.

Here is a simple visual showing how quickly tech adoption has risen in PMS globally:

The Human Touch Still Matters in a Data-Driven World

No matter how advanced technology becomes, human expertise continues to play an important role in the Future of Portfolio Management. Machines can analyse data, but they cannot understand market sentiment the way humans do.

Portfolio managers interpret complex events, adjust strategies in uncertain times, and provide emotional balance when markets become volatile. They help prevent impulsive decisions that often lead to losses.

Why Portfolio Management Will Grow Rapidly in India?

India is entering a powerful investment phase. Rising incomes, digital financial literacy, and a booming economy are pushing more people toward structured wealth creation. This is increasing the adoption of portfolio management services across cities and small towns.

Here are some key reasons why India is becoming one of the fastest-growing markets in the world.

-

- Strong economic growth

-

- Wider access to financial tools

-

- Increased awareness about long-term planning

-

- Younger population entering wealth-building years

-

- Rising preference for expert-managed portfolios

These changes are setting a foundation where professional portfolio management becomes a necessity rather than a luxury.

Where the Future of Portfolio Management Is Headed?

The Future of Portfolio Management will focus on smarter systems, better investor experiences, and highly adaptive strategies.

Here is what investors should prepare for:-

-

- Predictive models are becoming more accurate

-

- Portfolios adapting automatically to market changes

-

- Deeper personalisation beyond financial behaviour

-

- More global investment options are becoming accessible

-

- Greater focus on safety, stability, and long-term planning

-

- Faster digital interactions and simpler onboarding

-

- A stronger combination of human insight and technical intelligence

This future will simplify decision-making while improving long-term returns.

Conclusion

The Future of Portfolio Management is being built on stronger technology, transparent communication, personalised strategies, and sustainable decision-making. For investors, this is an opportunity to move beyond traditional methods and adopt smarter systems that protect wealth and multiply it steadily.

The world is changing, and investments are changing with it. The future belongs to those who are informed, prepared, and ready to take advantage of these new possibilities. This is the right time for every investor to explore modern portfolio management and step confidently into a more intelligent financial journey.

AISP steps into this evolving space with a forward-thinking approach. By combining integrated systems, detailed analytics, and streamlined processes, AISP supports businesses and institutional clients in building portfolios that remain resilient and growth-oriented.